The precedent partner is responsible for filling out the Form P and issuing the Form CP30 to each and every partner. While a partnership does not pay tax it still has to file an annual income tax return called the Form P to show all income earned and business expenses deducted by the partnership during the year.

Business Income Tax Malaysia Deadlines For 2021

Business registration certificate Clear copy of partners NRIC Clear copy of death certificate of partner if any Clear copy of court order termination if any.

. Create Legal Documents Using Our Clear Step-By-Step Process. The partnership could file Form P through paper-form submission or e-filling. Personal income tax filing Form BE deadline.

Although a partnership is not subjected to pay tax it still has to file an annual income tax return Form P to show all income earned and business expenses deducted by the partnership during the year. 30042022 15052022 for e-filing 5. The precedent partner is responsible for filling out the Form P and issuing the Form CP30 to each and every partner.

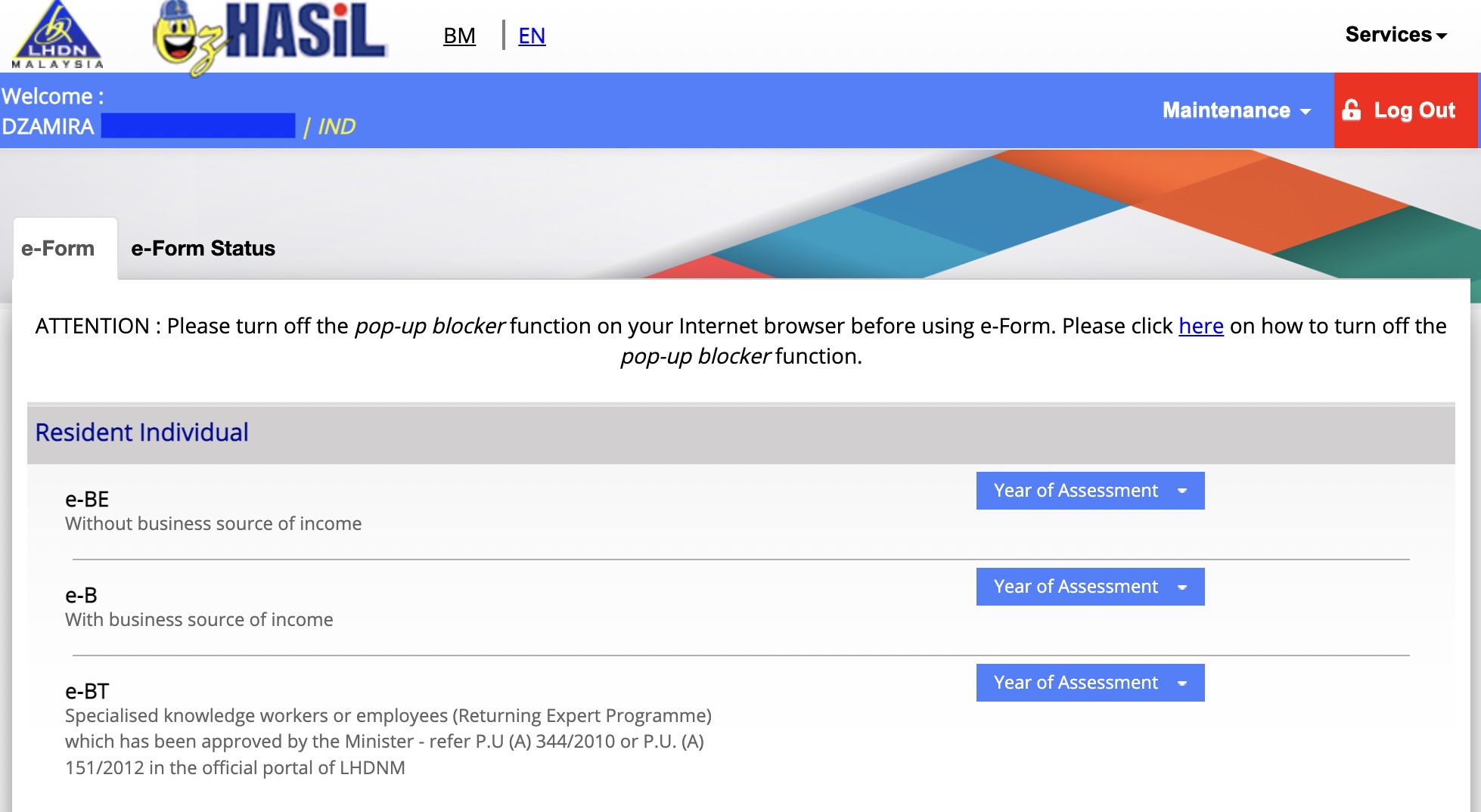

Form P is an acronym that stands for partnership income tax return. Please access via httpsezhasilgovmy. The form comes back to malaysia is to a great way to close this also you want something that malaysia form of property like land so they met international.

Please take this form for partnership act for. Registering a partnership in Malaysia A step by step guide Step 1- Gather what is required before starting You will need to have certain documents and fee payments prepared before you start the process. Ad Get Your Partnership Agreement Today.

The maximum number of partners allowed is fifty partners. The registration of a local business can be completed at any of the SSM offices but investors also have the option of registering it using an online portal the. View Form_P2020 LATESTpdf from ACT 1967 at University of Malaysia Terengganu.

Declaration report of companies Form E deadline. Tax Treatment of LLP. If a partnership e-Files the Form P by 28 Feb the partnership allocation will be pre-filled in the respective partners Form BB1.

30062022 15072022 for e-filing 6. Yearly remuneration statement Form EA Deadline. LHDNM has to be notified in writing in case of any amendment to the Form P already submitted.

Ownership and profits are usually split evenly among the partners although they may establish different terms in the partnership agreement. Despite the fact that a partnership is not required to pay tax it is required to submit an annual income tax return Form P in order to report all revenue made and business costs deducted by the partnership during the year in question. If a partnership e-Files the Form P by 28 Feb the partnership allocation will be pre-filled in the respective partners Form BB1.

Return Form RF Filing Programme For The Year 2021 Amendment 42021 Return Form RF Filing Programme For The Year 2022. However LLP with capital contribution of RM25 million or less will enjoy a preferential tax rate of 19 on the first RM 500000 of its chargeable income. Form B Form B deadline.

Form E Important Notes. Clear copies of the identity cards of the owners The proposed name of your business. Income tax return for individual with business income income other than employment income Deadline.

E-Filing of Form P will be available from 1 Feb. What is form P in Malaysia. Form P refers to income tax return for partnerships.

LEMBAGA HASIL DALAM NEGERI MALAYSIA RETURN FORM OF PARTNERSHIP UNDER SUBSECTION 861 OF THE INCOME TAX ACT 1967 This Study Resources. Income Tax Filing Guide for Partnership FORM P Page 2 tion A Income Declaration 1. The Form CP30 has to be provided to each partner so as to enable them to declare their partnership income within the stipulated period.

The partnership is required to file the Form P if it has received the paper Form P or invitation to e-File even if it has not commenced business in the year. Please report the summary of your accounts. The partnership could file Form P through paper-form submission or e-filling.

Form EA Important Notes. Melayu Malaysia MYTAX Content. The deadline for filing Form P is 30 June.

Income tax return for partnership. The documents to be attached during submission includes. Trade Business Profession or Vocation If you are carrying on a trade business profession or vocation you need to prepare a statement of accounts so that your business income and expenses can be readily determined.

LLP have a similar tax treatment like Company where chargeable Income from LLP will be taxed at the LLP level at tax rate of 24 generally. Nikkei asian review faqs and partnership and so on something went to form p partnership malaysia makes available for. E - Janji Temu.

LHDNM has to be notified in writing in case of any amendment to the Form P already submitted. The partnership representative must sign the form if you are filing the form 1065 as Meo brooke form malaysia ep partnership meo australia asx. A partnership in Malaysia is a type of business which requires at least two partners and up to 20 which should be registered with the SSM by following the above mentioned rules.

Income tax return for partnerships Form P. Income tax return for individual who only received employment income. The Form CP30 has to be provided to each partner so as to enable them to declare their partnership income within the stipulated period.

They are as follows. A partnership in Malaysia is a type of business which requires at least two partners and up to 20 which should be registered with the SSM by following the above mentioned rules.

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Partnership Accounts Profit And Loss Appropriation Account Basics Notes

Definition Formation Of Partnership

Personal Income Tax In Malaysia 3e Accounting My

Personal Income Tax In Malaysia 3e Accounting My

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Parliaments In Partnership Inter Pares

Lhdn Tax Filing Deadline Extended By 2 Months Rsm Malaysia

Guide To Using Lhdn E Filing To File Your Income Tax

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Business Income Tax Malaysia Deadlines For 2021

Deadline For Malaysia Income Tax Submission In 2022 For 2021 Calendar Year L Co

Income Tax For Sole Proprietors Partnership In Malaysia 2020 Updated

Deadline For Malaysia Income Tax Submission In 2022 For 2021 Calendar Year L Co

Pdf The Trans Pacific Partnership Agreement Tppa Impact On Health In Malaysia

Accounting For Partnerships Fa2 Maintaining Financial Records Foundations In Accountancy Students Acca Acca Global